GM 👋

This is the Smoothie Newsletter.

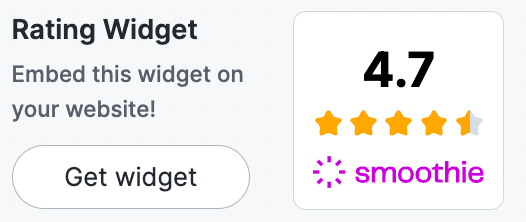

Today, we released our Rating Widget!

This allows for companies to share their Smoothie ratings of their products on their own websites.

It updates live so they can set it and forget it 👍

Do you have a web3 company and want this widget? Simply reply to this email!

The Merge happened over a year ago on Sept 15, 2022.

Today, we’re going to look at what it promised and whether has it achieved its goal or not.

On this day, the Ethereum network moved from Proof of Work to Proof of Stake consensus.

Note: If more ETH is issued than burned, ETH will remain an inflationary token. To make it truly deflationary, the issuance rate has to fall below the burn rate.

However, to make ETH deflationary, it needs more on-chain activity thus increasing the burned ETH and reducing supply.

And I believe that ETH’s Gas Price is a major factor in that.

Unless Ethereum finds a way to reduce gas prices, the network might not scale to the point that it’s burning more ETH than it’s creating.

This is a special newsletter. Every week, we deconstruct the best crypto trends and share those insights with you.